In recent years, the trade landscape has become increasingly complex, particularly between major economies like China and the United States. Amidst the backdrop of imposed tariffs and heightened trade tensions, one sector that has demonstrated remarkable resilience is the manufacturing of PVC cladding panels. These versatile and durable materials have become a staple in construction and architectural design, offering an attractive balance of functionality and aesthetic appeal. Despite the challenges presented by the escalating tariff situation, Chinese manufacturers have not only maintained their production levels but have also seized opportunities to innovate and improve their offerings. This blog will explore the strategies employed by Chinese PVC cladding panel producers to navigate these obstacles, as well as the implications for the global market in light of these developments.

Amid the challenges posed by tariffs, the Chinese PVC cladding market is witnessing a remarkable transformation. Manufacturers are pivoting towards innovative solutions to maintain competitive pricing and meet the evolving demands of both domestic and international clients. One key trend is the diversification of material sources. By tapping into alternative raw materials, companies are not only offsetting tariff impacts but also enhancing the sustainability profile of their products.

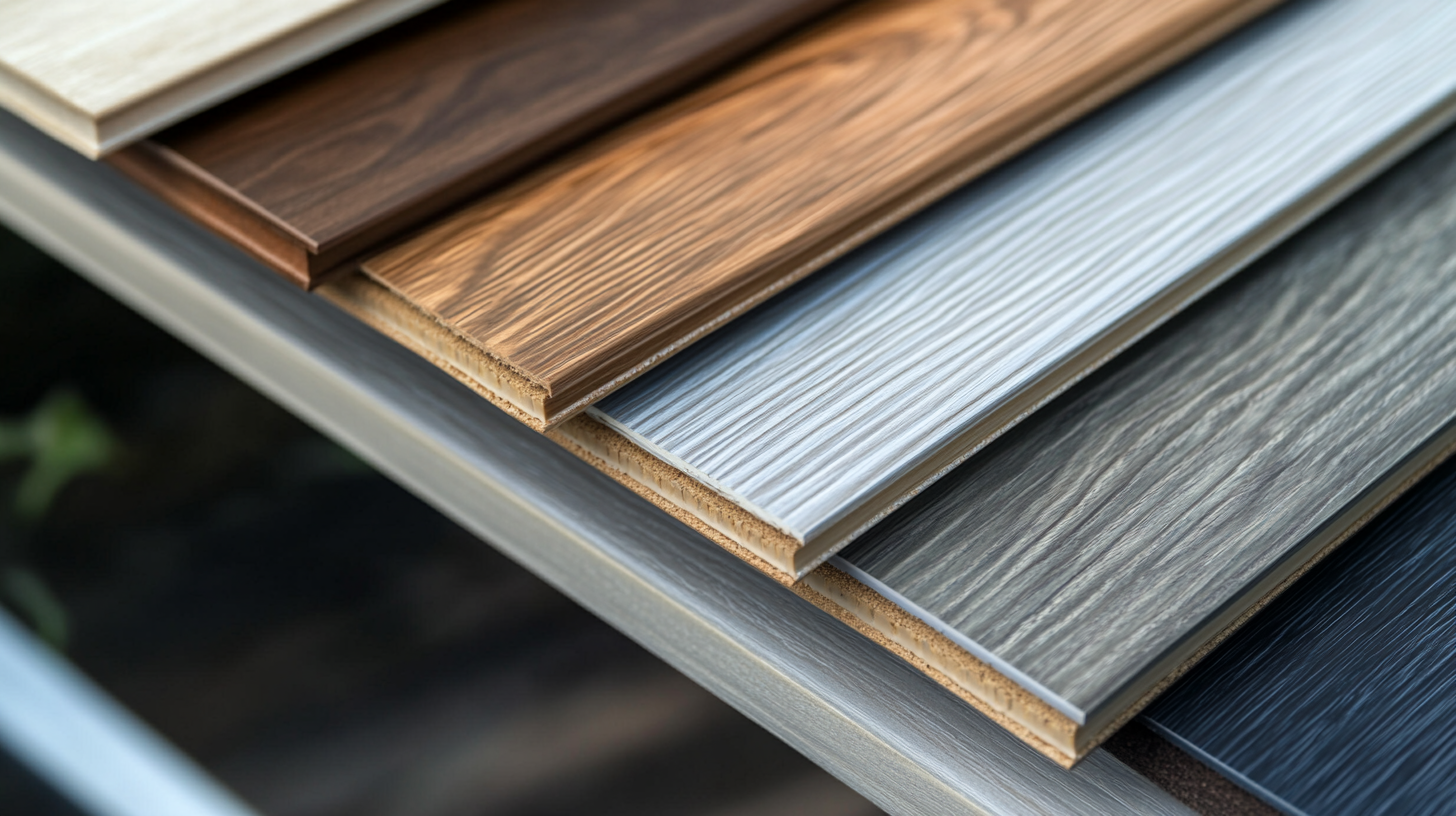

Additionally, there is a notable shift towards customization and design flexibility. As consumer preferences evolve, manufacturers are increasingly offering a range of styles, colors, and finishes in PVC cladding panels. This commitment to innovation not only satisfies aesthetic demands but also opens up new markets as builders and architects seek unique materials for their projects. Ultimately, the resilience of the Chinese PVC cladding industry in the face of tariff pressures speaks to its agility and forward-thinking approach, positioning it well for future growth.

This pie chart illustrates the market share distribution of PVC cladding panels in China for the year 2023. The residential sector leads with 45%, followed by commercial applications at 35%, industrial use at 15%, and agricultural sectors making up 5% of the market.

Chinese PVC cladding panels have witnessed a remarkable resurgence despite the tariff challenges imposed on imports. In this competitive landscape, manufacturers are deploying innovative strategies to navigate the complexities of the global market. One notable approach has been the diversification of supply chains. By sourcing raw materials from various locations, manufacturers are not only stabilizing costs but also reducing dependency on single suppliers. This adaptability enables them to buffer against tariff fluctuations and maintain price competitiveness.

Moreover, Chinese manufacturers are increasingly investing in advanced technology and automation in their production processes. This shift not only enhances efficiency but also improves product quality, making Chinese PVC cladding panels an attractive option for international buyers. Furthermore, by leveraging data analytics and market insights, companies can tailor their offerings to meet specific needs of varying markets, allowing them to stay ahead of competitors. Such innovative tactics are not only helping Chinese manufacturers to mitigate tariff impacts but also positioning them for sustainable growth in the global cladding industry.

The implementation of tariffs has created ripples across various sectors, with the PVC cladding industry being no exception. Recent reports indicate that new duties could lead to increased commodity prices, adversely affecting supply chains and significant trade relationships. For instance, the chemical industry is advocating for revisions in customs duties within the upcoming Union Budget 2025 to bolster domestic manufacturing capabilities. Analysts estimate that the imposition of these tariffs could escalate production costs by approximately 20%, thereby jeopardizing the competitive edge of PVC products against alternatives.

Moreover, industry groups have expressed deep concerns about the long-term implications of tariffs on the plastics segment, highlighting that they could not only disrupt supply chains but also lead to severe repercussions for recycling and waste management sectors. The uncertainty surrounding freight rates, instigated by fears related to tariff changes, further complicates the landscape, with estimates suggesting potential hikes in logistics costs of up to 15%. As tariffs target essential materials, manufacturers in the PVC cladding market are compelled to innovate and adapt to an evolving economic environment to navigate through these challenges effectively.

Amidst the challenges posed by U.S. tariffs, several Chinese companies have exemplified resilience and adaptability in the production of PVC cladding panels. These success stories reveal how some manufacturers are not only surviving but thriving despite economic pressures. For instance, by streamlining their supply chains and investing in technology, companies have managed to reduce production costs while maintaining high-quality standards. This innovative approach has enabled them to offer competitive prices even in a challenging market environment.

One effective strategy for these businesses has been to diversify their export markets. By exploring opportunities in Europe, Southeast Asia, and other regions, they have lessened their reliance on the U.S. market. Expanding their reach not only buffers against tariff impacts but also opens new avenues for growth.

**Tip:** Consider investing in sustainable production practices to appeal to environmentally conscious markets.

Additionally, forming strategic partnerships with local distributors can enhance market penetration and foster brand loyalty in new regions. Tailoring marketing strategies to the unique needs of diverse consumer bases has proven essential for sustaining demand and fostering long-term success.

**Tip:** Regularly assess market trends and consumer preferences to stay ahead of the competition.

The PVC cladding industry has faced significant challenges due to tariffs and trade restrictions over the past few years. Despite these barriers, market resilience is becoming increasingly evident. According to a recent report from Grand View Research, the global PVC cladding market is projected to reach USD 20.5 billion by 2027, growing at a compound annual growth rate (CAGR) of 5.6%. This growth is fueled by a rising demand for sustainable and low-maintenance building materials, which PVC cladding effectively fulfills.

As manufacturers adapt to a changing trade environment, many are investing in advanced technologies and sustainable practices to stay competitive. A study by MarketsandMarkets highlights that the Asia-Pacific region, particularly China, is expected to dominate the PVC cladding market, driven by lower production costs and innovations in product design. Additionally, the introduction of eco-friendly formulations is resonating with environmentally conscious consumers, further bolstering demand. Thus, while tariffs pose challenges, the industry's proactive strategies suggest a robust future, as the PVC cladding sector evolves in response to market dynamics.